Why Stability and Trust Define Crypto Exchange Success

In today’s crowded crypto market, platform stability and user trust are no longer competitive advantages—they are baseline expectations. Traders in the United States and the United Kingdom expect crypto exchanges to operate reliably during both normal conditions and extreme market volatility. Even brief downtime, delayed order execution, or unexplained balance issues can lead to rapid user churn and long-term reputational damage.

Many exchanges fail not because of poor market positioning, but because their crypto exchange development approach prioritizes speed over resilience. When backend systems are fragile or poorly monitored, technical issues quickly erode confidence. Users may tolerate market losses, but they rarely forgive platform failures.

Modern crypto exchange platform development focuses on creating systems that remain stable under pressure and transparent in operation. Stability builds confidence, while trust encourages long-term engagement, higher trading volumes, and institutional participation. This blog explores the development approaches that help exchanges achieve both.

Why stability and trust are tightly connected

- System outages directly impact user funds and trades

- Inconsistent performance creates suspicion among traders

- Regulatory scrutiny increases after operational failures

- Trust once lost is difficult to recover

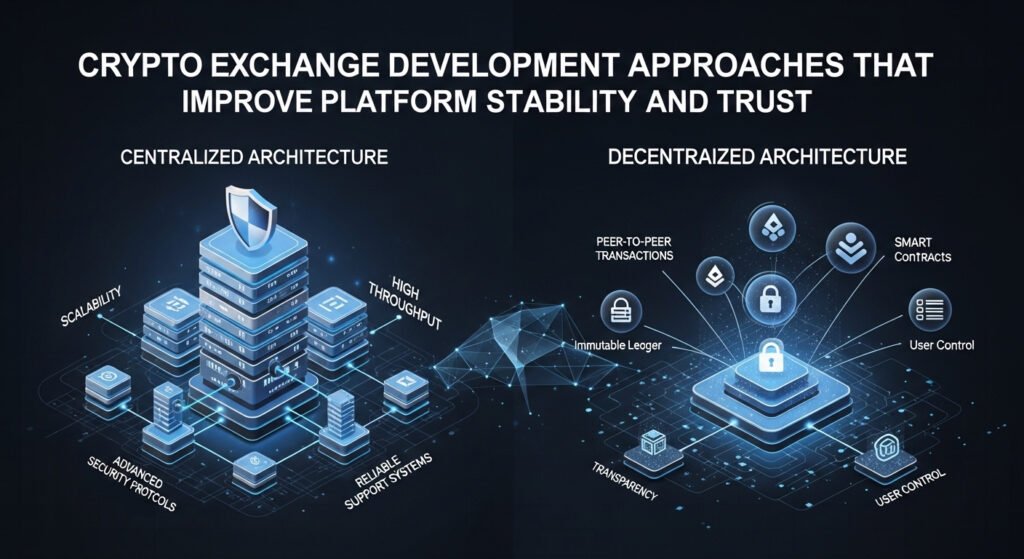

Building Stable Architecture Through Smart System Design

Platform stability begins at the architectural level. Exchanges designed without scalability and fault tolerance often struggle as user activity grows.

Risks of weak architectural foundations

Poor cryptocurrency exchange software development can result in:

- Single points of failure across core services

- Tight coupling between trading, wallets, and APIs

- Limited ability to scale during demand surges

- Slow recovery from partial outages

These issues make even minor disruptions visible to users.

Architecture choices that improve stability

Advanced crypto exchange platform development emphasizes:

- Modular service-based architecture

- Independent scaling of critical components

- Redundant infrastructure across regions

- Automated failover mechanisms

This design ensures that issues in one component do not bring down the entire platform.

Role of a crypto exchange development company

An experienced crypto exchange development company anticipates growth patterns and stress scenarios, building systems that remain stable as usage expands across US and UK markets.

Reliable Trading Engine Design That Builds User Confidence

The trading engine is where trust is tested most directly. Users expect trades to execute fairly, consistently, and transparently.

How instability affects trade confidence

When trading engines are poorly designed, users may experience:

- Delayed or failed order execution

- Inconsistent price matching

- Discrepancies between expected and actual fills

- Difficulty verifying trade outcomes

These problems raise concerns about fairness and integrity.

Development practices that enhance execution reliability

Effective crypto exchange development services focus on:

- Deterministic order matching logic

- Accurate time sequencing of trades

- Consistent performance under heavy load

- Comprehensive logging for audit and dispute resolution

Stable execution reassures traders that the platform operates fairly, even during volatile periods.

API Performance and Its Impact on Trust

APIs are critical for professional traders, market makers, and institutional users. API instability quickly undermines confidence.

Common API-related trust issues

- Frequent timeouts or connection drops

- Delayed market data updates

- Inconsistent order acknowledgments

- Unclear error handling

These issues can cause financial losses for algorithmic traders.

Smart API development strategies

Modern crypto exchange software development includes:

- Tiered rate limiting based on usage profiles

- Priority routing for trade-critical requests

- Continuous API performance monitoring

- Transparent error reporting

Reliable APIs signal technical maturity and professionalism to users in regulated markets like the United States and the United Kingdom.

Security-Driven Development That Reinforces Trust

Security incidents are among the fastest ways to destroy trust in a crypto exchange. Stable platforms must also be secure platforms.

Security failures that damage credibility

- Unauthorized withdrawals

- Account takeovers

- Insider access abuse

- Delayed incident response

Even isolated incidents can lead to mass withdrawals.

Secure development approaches that scale

A capable cryptocurrency exchange development company embeds:

- Behavior-based anomaly detection

- Segregated access controls for administrators

- Multi-layer withdrawal verification

- Continuous security monitoring

When users see consistent protection of assets, trust grows organically.

Transparency, Monitoring, and Operational Visibility

Trust is reinforced when users believe the platform is well-managed and responsive.

Risks of poor operational visibility

- Delayed issue resolution

- Lack of clarity during incidents

- Inability to communicate accurately with users

- Regulatory reporting challenges

These gaps create uncertainty.

Development practices that enhance transparency

Modern crypto exchange development services support:

- Real-time system health dashboards

- Automated alerts for anomalies

- Clear operational status updates

- Detailed audit trails

Transparency reassures users that the exchange is under control, even during disruptions.

Compliance-Ready Development for Regulated Markets

Trust is closely linked to regulatory alignment, especially in the US and UK.

Compliance challenges affecting trust

- Inconsistent KYC and AML enforcement

- Poor record-keeping

- Slow response to regulatory inquiries

- Lack of audit readiness

These issues raise red flags for users and authorities alike.

Compliance-focused development strategies

Crypto exchange platform development today integrates:

- Automated compliance monitoring

- Standardized reporting workflows

- Secure data retention policies

- Clear governance controls

Compliance-ready platforms inspire confidence among both retail and institutional users.

Conclusion: Stability and Trust Are Built, Not Promised

Platform stability and user trust are not achieved through marketing claims—they are earned through disciplined crypto exchange development. Exchanges that invest in resilient architecture, reliable execution, secure systems, transparent operations, and compliance-ready infrastructure position themselves for long-term success.

For businesses in the United States and the United Kingdom, partnering with an experienced crypto exchange development company and leveraging robust crypto exchange development services is essential to building platforms users can trust. When stability becomes the norm rather than the exception, trust follows naturally and so does sustainable growth.