In the field of managing people’s money as well as business succession, estate planning is thought of as a family issue, whereas IRC compliance is seen as a business requirement. Nevertheless, these two components are connected, particularly concerning concentrative wealth, family enterprises, and newcomers in the United States. Inappropriately aligned estate planning strategies and tax law may end up giving rise to unpredicted tax liabilities, probate delay, or even IRS audit.

That is why a tax attorney is particularly important at this stage. This is because a tax attorney is in a position to analyze the circumstances of the case and advice the client appropriately. The tax attorney lawyer is someone who can guide the individual on the state of taxes regarding estates, and through that, one can have the potential chance to make the changes happen.

While engaging the services of an estate planner or an accountant, you will be assured of both federal tax knowledge and structures through a tax attorney.

Role of a Tax Attorney in Structuring

A tax attorney is not a professional you turn to only when you get a knock on the door from the Internal Revenue Service; instead, they are involved in planning one’s estate. Their primary roles include:

· Asset Base and Tax Exposure

Tax attorneys take into consideration a number of things, so what they take into account is: your net worth, what nature of what you have, like advances in real estate, investments, retirement plans, shares in businesses, and others, and future liabilities that can be determined by the IRC. This is done to assist in creating a plan concerning the manner in which one can avoid the estate and gift taxes.

· Drafting Legal Structures

They oversee generation-skipping trusts, GRATs, FLPs, and CRTs – all designed to facilitate change of ownership without necessarily incurring taxes.

· Role in Business Succession Planning

In the United States, especially where the business is a family business, to minimize the life and estate tax issues with the IRS, a tax attorney establishes a buy-sell agreement and transfer provisions, as well as valuation methods. Help from the tax attorney in Pasadena or other places is the one who can regulate and mandate the process of succession planning.

Transferring of the estate is one of the key tasks through which one can make the succession planning successful.

FAQs

1. Why is it important to consider IRS compliance when planning an estate?

While estate planning is often viewed as a family issue, it is directly connected to IRS compliance, which is a business requirement. Misaligned estate planning strategies and tax laws can result in unforeseen tax liabilities, probate delays, and even IRS audits. This is especially critical for high-net-worth individuals and those with family businesses or complicated family situations.

2. What is the primary role of a tax attorney in the estate planning process?

A tax attorney is not just for handling IRS problems; they are essential in the proactive planning of an estate. Their role is to analyze a client’s individual circumstances to provide proper advice. They guide individuals on estate tax laws, helping them make beneficial changes to their plan. Hiring a tax attorney ensures that you have expertise in both federal tax law and legal structures.

3. What are the key tax components of estate planning in the United States?

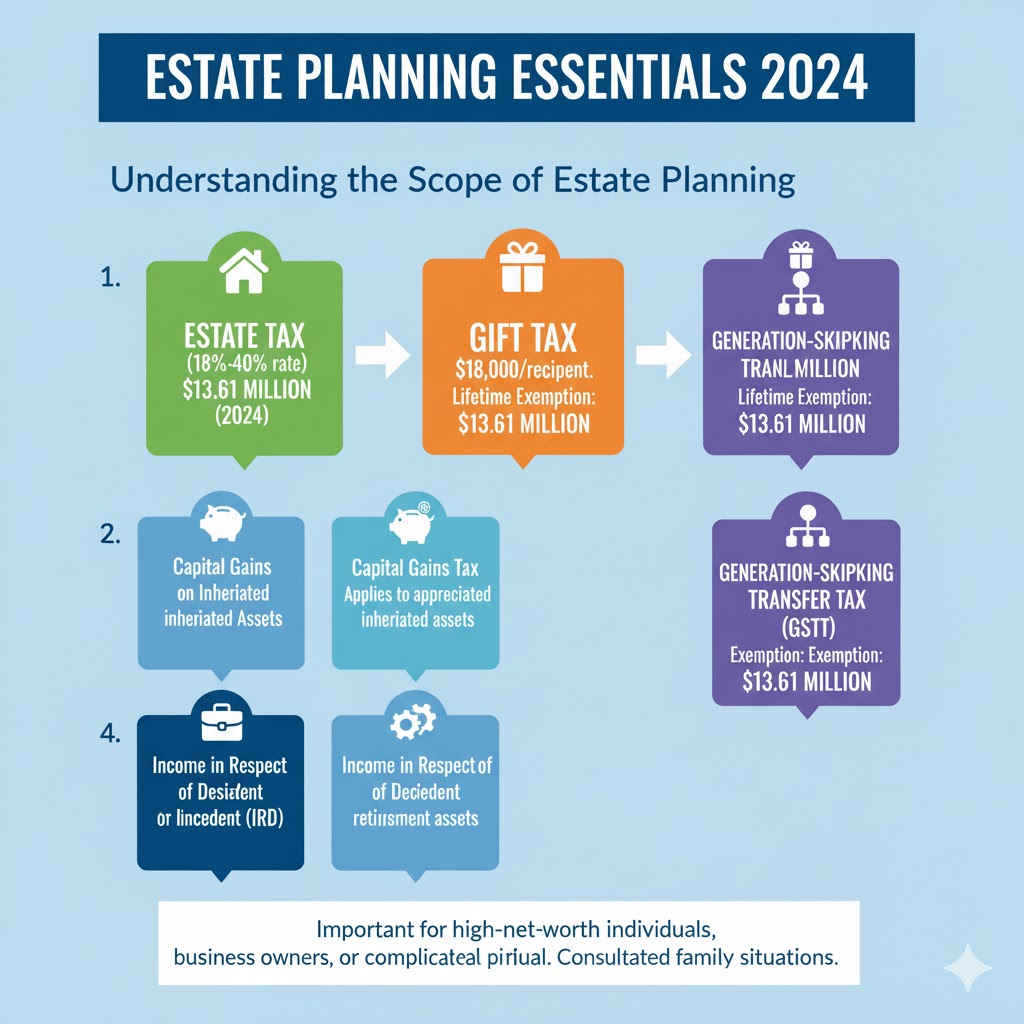

Estate planning in the U.S. involves state probate laws along with federal estate and tax laws from the IRS. The main tax components include:

- Estate Tax: For 2024, tax rates range from 18% to 40% for estates valued at over $13.61 million.

- Gift Tax: This has a lifetime exemption that corresponds with the estate tax exemption.

- Generation-Skipping Transfer Tax (GSTT).

- Capital Gains Tax: This tax may apply to inherited assets.

- Income in Respect of a Decedent (IRD): These rules are particularly relevant for business owners or those with retirement assets.