In recent years, governments worldwide have increasingly focused on public health initiatives to combat lifestyle-related diseases. Among these initiatives, sugar taxation has emerged as a significant regulatory tool to reduce the consumption of high-sugar products. For businesses involved in food and beverage production, understanding the sugar levels in their products is no longer optional—it is a legal and financial necessity. Failing to accurately measure, disclose, or manage sugar content can result in severe tax penalties, reputational damage, and compliance challenges.

This article explores why monitoring sugar levels is critical for businesses, the mechanisms of sugar taxation, and the practical steps companies can take to ensure compliance while maintaining consumer trust.

The Global Trend of Sugar Taxation

Sugar taxes have become increasingly common as governments attempt to address rising rates of obesity, diabetes, and other health conditions linked to excessive sugar consumption. These taxes are generally levied on manufacturers, importers, or retailers of high-sugar products, and the rates often depend on the amount of sugar per serving or per 100 milliliters in beverages.

Countries such as the United Kingdom, Mexico, South Africa, and several U.S. states have implemented varying forms of sugar taxes targeting soft drinks, sugary snacks, and processed foods. The primary goal is to discourage high sugar consumption while encouraging the production of healthier alternatives.

For companies, this global trend signifies that sugar compliance is not restricted to domestic operations. Multinational manufacturers must understand the regulatory landscape in each market they operate in to avoid costly penalties and distribution disruptions.

NOTE:- Our team at Holistic International Testing Services FZ LLC executed the Added Sugar Test For Federal Tax Authority accurately and efficiently. Each sample was evaluated with precision, providing clients with full regulatory compliance assurance. Trust Holistic International Testing Services FZ LLC for reliable, professional laboratory testing services today.

How Sugar Levels Affect Tax Liability

The amount of sugar in a product directly influences its tax classification and the rate imposed. For instance, beverages exceeding a specific sugar threshold may be taxed at a higher rate than those under the limit. Similarly, foods with sugar content above defined levels may attract additional excise duties.

Misreporting sugar content, whether intentional or due to inadequate testing, can trigger tax penalties, fines, or even legal action. Some jurisdictions also impose retrospective taxes if discrepancies are discovered during audits. Therefore, businesses must ensure accurate measurement, labeling, and reporting of sugar levels to minimize financial and legal risks.

Beyond direct financial implications, there is also a reputational component. Consumers increasingly value transparency and health-consciousness. Products found to have inaccurate sugar declarations may face public backlash, potentially harming brand loyalty and sales.

Understanding Regulatory Definitions and Standards

One of the major challenges in sugar compliance is the variation in regulatory definitions and standards across regions. Authorities may differ in what constitutes “sugar” for taxation purposes, distinguishing between added sugars, natural sugars, or total sugar content.

For example, some regulations focus solely on added sugars in processed foods, while others consider naturally occurring sugars in fruit juices or dairy products. Understanding these definitions is critical because they determine how a product is categorized and which tax rate applies.

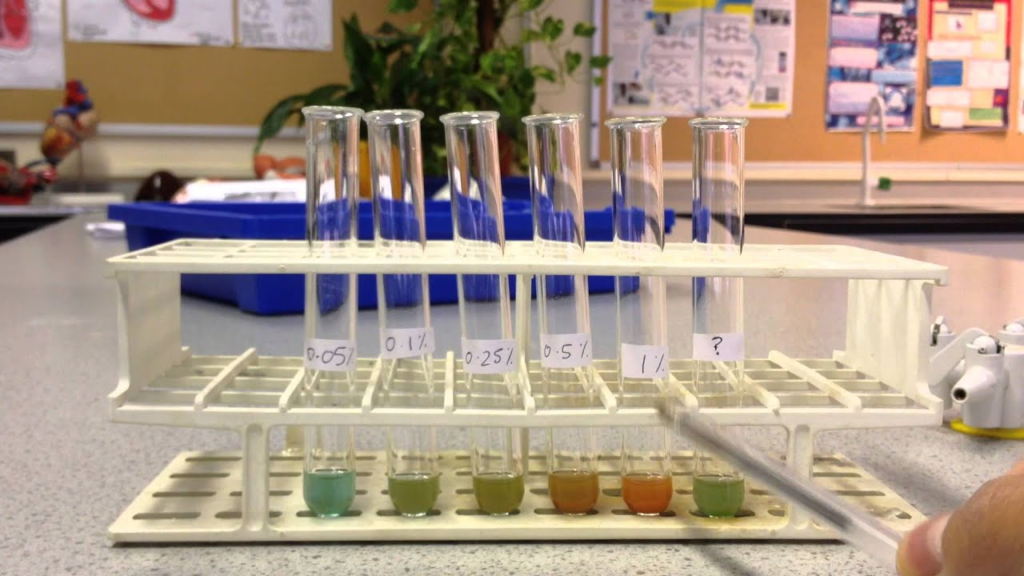

Manufacturers must also adhere to specific analytical methods approved by regulatory agencies for sugar measurement. Using non-standard testing methods may result in non-compliance, even if the actual sugar content is within permissible limits.

The Role of Accurate Testing and Reporting

Accurate testing and reporting of sugar content are the cornerstone of compliance. Food and beverage companies should implement robust quality control systems to monitor sugar levels throughout the production process. Laboratory testing, whether in-house or through certified third-party facilities, ensures that the sugar content meets regulatory thresholds.

Accurate labeling is another critical aspect. Regulatory authorities often require that sugar content be clearly listed on product packaging. Mislabeling, whether due to oversight or faulty calculations, can trigger audits and penalties.

Investing in precise measurement tools and standardized reporting procedures not only prevents tax issues but also enhances consumer trust, showing commitment to transparency and health-conscious practices.

Potential Tax Penalties and Legal Risks

Failure to comply with sugar tax regulations can result in significant financial and legal consequences. Common penalties include monetary fines, additional tax assessments, and potential suspension of licenses or product distribution rights. In extreme cases, criminal liability may arise if intentional misreporting or fraud is detected.

Tax authorities are increasingly using sophisticated audit tools, data analytics, and cross-border information exchange to identify non-compliance. Companies that neglect proper monitoring of sugar levels expose themselves to heightened risk of enforcement action.

Moreover, reputational damage stemming from non-compliance can indirectly affect revenue. Negative publicity regarding excessive sugar content or inaccurate labeling may lead to consumer boycotts or loss of business partnerships.

Strategic Approaches for Compliance

Businesses can adopt several strategies to manage sugar levels and avoid penalties:

Product Reformulation

Reducing sugar content through reformulation is a proactive approach. By adjusting recipes, incorporating alternative sweeteners, or enhancing flavors naturally, manufacturers can lower the tax burden while meeting consumer demand for healthier products.

Implementing Quality Management Systems

Establishing internal protocols for regular testing, documentation, and reporting ensures that sugar content is consistently monitored. Integrating these processes into quality management systems enhances the accuracy and reliability of compliance.

Engaging Regulatory Expertise

Consulting with regulatory specialists helps businesses navigate the complex landscape of sugar taxation. Experts can provide guidance on permissible thresholds, approved testing methods, and reporting requirements across jurisdictions.

Consumer Education and Transparency

Clear labeling and educational initiatives can reduce risk and enhance brand reputation. Informing consumers about sugar content, health benefits, and alternatives strengthens trust and aligns with regulatory expectations.

The Business Case for Proactive Sugar Management

Managing sugar levels is not just about compliance; it also offers strategic advantages. Products with lower sugar content are increasingly favored by health-conscious consumers, presenting an opportunity to differentiate in a competitive market.

Moreover, proactive management reduces the risk of unexpected tax liabilities and ensures smoother operations. Companies that integrate sugar monitoring into their product development cycle are better positioned to adapt to evolving regulations and market trends.

Conclusion

Understanding sugar levels in products is a critical responsibility for any food and beverage manufacturer, retailer, or distributor. Accurate measurement, reporting, and strategic management of sugar content are essential to avoid tax penalties, maintain regulatory compliance, and safeguard brand reputation.

As sugar taxes continue to expand globally, businesses must adopt proactive approaches, including product reformulation, rigorous testing, and transparent communication with consumers. By doing so, companies not only protect themselves from financial and legal risks but also align with the broader societal shift toward healthier, more sustainable consumption.

In today’s regulatory landscape, ignorance or oversight regarding sugar levels is no longer an option. Businesses that prioritize compliance and proactive sugar management are likely to achieve both legal security and competitive advantage, ensuring long-term growth and consumer trust.

For more insightful articles related to this topic, feel free to visit – todayigosolar